Managing International Trusts: The Essential Role of an Offshore Trustee

Managing International Trusts: The Essential Role of an Offshore Trustee

Blog Article

Comprehending the Function of an Offshore Trustee: What You Required to Know

The function of an overseas trustee is commonly misinterpreted, yet it plays a pivotal component in protecting and taking care of possessions throughout borders. The details included in picking the best trustee and the possible repercussions of that selection warrant cautious factor to consider.

What Is an Offshore Trustee?

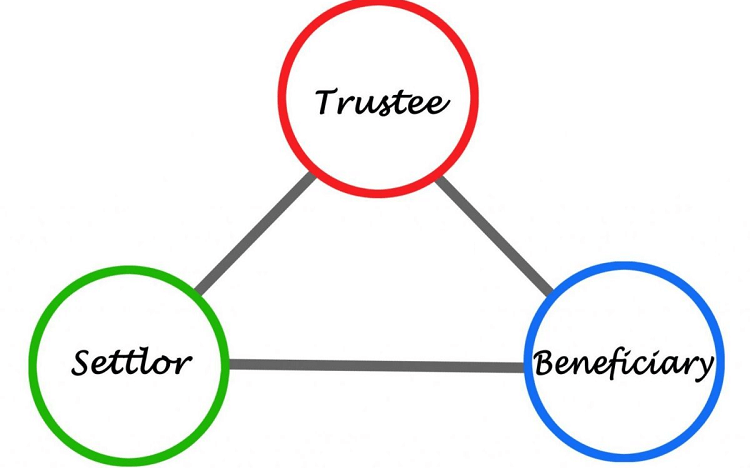

An offshore trustee is a specialized fiduciary who carries out depends on established in territories outside the individual's nation of home. This role commonly develops from the wish for asset security, tax effectiveness, or enhanced personal privacy. Offshore trustees are frequently used by individuals looking for to manage their riches in a fashion that follows international guidelines while optimizing benefits managed by particular territories.

The choice of an offshore trustee is crucial, as it entails leaving them with significant financial assets and the authority to choose pertaining to the management and distribution of those assets. Offshore trustees may be establishments or individuals, such as banks or count on firms, and they should possess a deep understanding of worldwide regulation, tax obligation laws, and the certain terms of the trust fund agreement.

Additionally, the jurisdictions in which these trustees run often have desirable legal structures that assist in effective depend on monitoring, supplying a layer of security and stability for the settlor's properties. It is important for people thinking about an overseas count on to involve with professional legal and economic experts to make sure that their selection of trustee aligns with their goals and follow the appropriate legislations.

Trick Duties of Offshore Trustees

Offshore trustees carry a series of crucial obligations that are important to the reliable administration of counts on. Among their key duties is to make sure conformity with the pertinent laws and regulations of the overseas jurisdiction, which requires an extensive understanding of both regional and international legal frameworks - offshore trustee. This helps protect the trust fund's assets and ensures proper tax obligation treatment

An additional vital responsibility is the accurate record-keeping and monetary coverage. Offshore trustees need to maintain detailed accounts of all purchases and provide beneficiaries with transparent reports, ensuring that the beneficiaries are educated regarding the count on's efficiency.

Furthermore, trustees should support fiduciary duties, acting in good confidence and focusing on the passions of the beneficiaries over their own. This entails making equitable and reasonable decisions relating to circulations and handling problems of passion. On the whole, an overseas trustee's function is essential in securing the count on's honesty and guaranteeing its long-lasting success.

Advantages of Using an Offshore Trustee

Making use of an overseas trustee offers countless benefits that can boost the management and security of count on assets. Among the key benefits is possession security. Offshore territories frequently offer robust lawful frameworks that safeguard properties from lenders, legal actions, and political instability in the grantor's home nation. This added layer of protection is particularly appealing for high-net-worth people looking for to preserve their wide range for future generations.

Additionally, overseas trustees typically possess specific expertise in international financing and tax obligation regulation, enabling them to optimize the depend on's economic structure. This competence can bring about favorable tax planning chances, as particular territories might supply tax obligation motivations that can boost the total worth of the trust fund.

Confidentiality is another substantial advantage; several overseas territories maintain stringent privacy laws that safeguard the details of the trust and its beneficiaries from public scrutiny. This discretion can be crucial for individuals aiming to keep discernment regarding their financial events.

In addition, offshore trustees offer a level of specialist administration that can make sure adherence to legal needs and ideal practices. By delegating these responsibilities to experienced specialists, trustors can concentrate on other facets of their economic planning while delighting in assurance concerning their count on properties.

When Picking a Trustee,## Elements to Consider.

Selecting the best trustee is a critical choice that can considerably impact the efficiency and longevity of a depend on. Several variables must be considered to make certain that the trustee lines up with the trust's purposes and beneficiaries' requirements.

To start with, assess the trustee's experience and experience in taking care of counts on. An ideal trustee must possess a strong understanding of depend on law, investment approaches, helpful site and financial administration. This expertise guarantees that the trust fund's assets are dealt with effectively and according to the settlor's wishes.

Secondly, take into consideration the trustee's reputation and reliability. Carrying out detailed research into the trustee's background, including recommendations and testimonials from previous customers, can provide insights into their credibility and expert conduct.

Furthermore, examine the trustee's communication skills and availability. A trustee has to be able to clearly verbalize trust-related matters to beneficiaries and come for updates and conversations.

Legal and Tax Obligation Effects

Browsing the legal and tax implications of selecting an overseas trustee is crucial for ensuring conformity and taking full advantage of the benefits of the count on structure. The option of jurisdiction plays a vital function in figuring out the lawful framework regulating the count on. Different jurisdictions have varying laws worrying property defense, personal privacy, and the legal rights of beneficiaries, which can considerably impact the efficacy of the trust fund.

Tax obligation effects are similarly vital. Beneficiaries may undergo tax obligations in their home nation on distributions obtained from the overseas count on. Furthermore, particular jurisdictions impose tax obligations check over here on the trust fund itself, which can deteriorate its general value. It is crucial to recognize the tax obligation treaties between the overseas territory and the beneficiary's nation to alleviate double taxes dangers.

In addition, compliance with coverage demands, such as the Foreign Account Tax Conformity Act (FATCA) for U.S. people, is needed to stay clear of charges. Engaging with tax obligation professionals and lawful advisors who specialize in offshore frameworks can offer crucial understandings and ensure the depend on is established and preserved in alignment with all appropriate regulations and policies. By meticulously thinking about these effects, individuals can secure their properties while enhancing their tax obligation positions.

Final Thought

To conclude, the role of an offshore trustee is essential for effective possession monitoring and protection. offshore trustee. By functioning as a fiduciary, overseas trustees make certain conformity with international policies, focus on beneficiaries' passions, and offer specialized competence in monetary and tax matters. When choosing a trustee, mindful factor to consider of variables such as experience, reputation, and jurisdictional implications is vital. Eventually, comprehending these aspects adds to educated decision-making pertaining to property management techniques and count on administration.

An offshore trustee is a customized fiduciary that provides counts on established in territories outside the person's country of house.Offshore trustees lug a variety of essential responsibilities that are important to the effective monitoring of depends on. In general, an offshore trustee's duty is important in safeguarding the trust fund's honesty and ensuring its lasting success.

Using an offshore trustee supplies many advantages that can enhance the monitoring and security of trust fund possessions.Browsing the lawful and tax effects of selecting an offshore trustee is essential for making certain compliance and optimizing the benefits of the depend on structure.

Report this page